- Date:

- 8 Oct 2021

The Tribunal received the following submissions, published in alphabetical order:

- Anthony S

- Brimbank Ratepayers & Residents Association, Inc.

- Chris Mack

- Christine Maynard

- Daniel Kade

- East Gippsland Shire Council

- Frank Donato

- Graham Jolly

- James Bae

- Kelly Rossiter

- Margaret Quon

- Marion Attwater

- Mio Ihashi

- Moonee Valley City Council

- Municipal Association of Victoria

- Ratepayers Victoria

- Sandra Taylor

- Sharyn More

- Sharyn Saxon

- Sustainability Action Network

- Theo Zographos

- Victorian Local Governance Association

The Tribunal received a further 11 submissions from parties that requested their submission be published in a de-identified form.

The Tribunal also received confidential submissions from several parties that did not give consent for their submission or name to be published.

Submissions have been published in their original form and have not been corrected for publication.

Submissions do not necessarily reflect the views of the Tribunal and assertions made in them have not been fact-checked.

All published submissions can be viewed at the links in the menu.

Anthony S

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

To whom it may concern,

I do NOT support the proposed increase in allowances for mayors, deputy mayors and councillors in this period of economic uncertainty. Local Government representatives should not be seeking any increases that puts added pressure on us the rate payers.

Regards

Anthony

Brimbank Ratepayers & Residents Association, Inc.

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors.

12 August 2021

Submission to the Victorian Independent Remuneration Tribunal – Determination of allowances for Mayors, Deputy Mayors and Councillors

1. About Brimbank

Brimbank is located in Melbourne’s west and is a large culturally diverse municipality covering twenty-five new and established suburbs. There are a few reasonably wealthy suburbs, however, Brimbank is mostly made up of suburbs considered to be disadvantaged. Brimbank has a SEIFA score (2016 Census) of 921 with 443 LGAs less disadvantaged1 and is ranked the second most disadvantaged municipality in metropolitan Melbourne by the ABS2.

Brimbank also has a chequered history. The Council was sacked in 2008 and has been managed by Administrators for eight of the past thirteen years, yet some of the factors which led to the sacking in 2008 are still evident today. In particular, third party intervention from state MPs, who appear to have very close personal relationships with Councillors, endorse and assist council candidates affiliated with their political party and in particular (and of significant concern to residents) the current Mayor who was personally endorsed by a State MP at the last Council election and is now, as residents report, seemingly closely collaborating with the State MP on projects which promote the MP and assist her to do her job within her electorate or promote her leading into next year’s state election, (redacted).

2. Roles of Mayor, Deputy Mayor and Councillors

2.1 Mayor

Residents accept that the role of the Mayor is as outlined in the Local Government Act 2020, Part 2, Division 3, 18(1). However, much to the great concern and utter dismay of residents, it appears that since elected Councils returned in 2016, state political interference has once again creeped in. Brimbank residents want their Councillors, and particularly their Mayor, to be free of any third party interference so that they perform their duties independently and solely with the interests of the ratepayers and residents that they represent in mind, not unrelated third parties, and particularly not government MPs who should be using their own (extensive) resources to support and represent their constituents.

(redacted)

Additionally, due to the issues highlighted above, residents believe that the Brimbank Mayor does not have the appropriate level of ability or skills to undertake the role of Mayor as identified in the Local Government Act 2020, Part 2, Division 3, 18 (1) (a) to (i). This is very concerning currently for Brimbank residents (redacted). Residents believe that this may be severely impacting on the ability of the current Mayor to advocate on behalf of the Brimbank community effectively and independently and has also severely diluted confidence within the community. The Mayor currently holds the Advocacy Portfolio, yet there are so many examples of poor advocacy being raised by residents which are negatively impacting on the community, including the Barro Landfill air pollution, the Sunshine Super Hub, Albion station, the Brimbank Aquatic and Wellness Centre lack of State funding, Sydenham Road, Taylors Road and Calder Highway upgrades, to name a few.

A particular concern that Brimbank residents have had and continue to have with their elected Mayors is the lack of transparency which is often evident. In particular, and something that is continually raised by residents is (redacted) and then provides vague reasons as to why the questions are disallowed. These are real concerns that Brimbank residents often raise and they believe it is not acceptable that they just get ‘batted’ away because they may be uncomfortable or embarrassing for the Mayor or other councillors to answer. Residents also believe that this conduct may contravene requirements under the Local Government Act 2020 and the Local Government (Governance and Integrity) Regulations 2020 Schedule 1—Standards of conduct Section 4 (2).

Despite Council implementing a comprehensive Public Transparency Policy in 2020 as required under LGA 2020, Part 3, Division 1, 57, questions asked by concerned residents relating to the current Mayor’s ability to advocate to the Victorian government on contentious issues, given her close personal relationship with State government MPs, are often not answered based on them being ‘defamatory’, which is incorrect and unacceptable and potentially contradicts the transparency and good governance requirements under the Local Government Act 2020. The relationship between the Mayor and a State MP is well known with residents observing them posting videos and other content across social media platforms etc., including the MP endorsing the current Mayor as a council candidate at the last election and the Mayor’s family working for the state MP, so it’s no secret and yet whenever concerned residents ask questions at Council meetings which may hint that (redacted). This response and lack of transparency and good governance builds discontent within the Brimbank community and could very well be viewed as unacceptable conduct under the Local Government (Governance and Integrity) Regulations 2020.

2.2 Deputy Mayor

Residents accept that the role of the Deputy Mayor is as outlined in the Local Government Act 2020, Part 2, Division 3, 21. However, once again,(redacted) etc. Given the number of issues which currently exist in Brimbank requiring strong competent advocacy, we would expect that the Deputy Mayor would be able to assist the Mayor on important advocacy issues, but unfortunately that has not occurred in the present Council.

2.3 Councillors

Residents accept that the role of Councillors is as outlined in the Local Government Act 2020, Part 2, Division 5, 28. (redacted) to advocate effectively for residents or to manage a large business/budget. These include an inability to communicate effectively and competently, public profile, community engagement, ability to lead and influence, commercial and/or financial acumen etc.

Residents report that Brimbank has a few independent Councillors who are currently doing a great job working for the community with one particular standout who is a second term Councillor who engages very well with the community, is very well respected and is strongly advocating and supporting residents severely affected by the Barro Landfill fires which are impacting on residents’ health and safety through poor air quality and noise pollution. Given the severity of this issue, as surely nothing is more important to the Mayor and Councillors than the health, safety and wellbeing of Brimbank residents, residents expect that all Brimbank Councillors and particularly the Mayor, would be out there competently and effectively advocating for urgent action, however, residents report that it appears to have been left to just one of the ward Councillors. Residents are also concerned that even the one other Councillor from the same ward affected by the Barro landfill issue has not bothered to attend community forums or show support to these affected residents publicly in any way which is deeply concerning for a proper functioning Council and potentially contravenes the Local Government (Governance and Integrity) Regulations 2020, Schedule 1, Section 2 (d) (Standards of Conduct) which clearly states that in the performance of their role, a Councillor must be “responsive to the diversity of interests and needs of the municipal community”, that they represent.

Furthermore, residents have observed that when Councillors are asked questions by residents both at Council meetings and on social media as to why they are not advocating strongly, effectively, and competently for particular projects or issues, the response is often that they are advocating in the background. This response is inadequate and unacceptable and in fact contravenes Council’s own Public Transparency Policy and the transparency requirements under the Local Government Act 2020 and it is obvious that these Councillors and the Mayor are not aware of this. It also impacts severely on residents’ confidence that Councillors are actually doing their job as this is not always obvious in Council meetings where again residents report that Councillors often don’t appear to be across issues, waffle on inexplicably without reference to the issue being discussed, don’t raise motions, and appear to make little contribution. (redacted) which is valuable and fundamental to our democracy and what Brimbank residents demand!

3. Purpose of allowances

Municipalities such as Brimbank are large businesses which require appropriately qualified and skilled Councillors to manage the business effectively for the good of all ratepayers and residents while always ensuring that rates are kept low, wasteful spending is minimised and accountability is increased.

We as residents believe that the purpose of allowances paid to the Mayor, Deputy Mayor and Councillors is to reimburse them for the time and effort they are putting into managing the municipality as community representatives. There is no doubt that if taken seriously and done properly, a significant amount of work is required by Councillors. Residents report that they have no issues with Councillors and the Mayor and Deputy Mayor receiving suitable compensation for the roles they are required to perform but when they don’t competently perform their duties to a satisfactory level, residents don’t believe they should continue to be compensated at the highest level possible, as is currently the case.

4. Factors to be considered when allocating councils to allowance categories

Residents don’t believe that the current system of allocating allowances based on population and revenue is adequate. Brimbank falls within Category 3 based on the current criteria which means that allowances are set at the highest range and at the beginning of each term for a four year period. This is despite the fact that Brimbank has many suburbs within it which are considered underprivileged with a third of residents earning under $500 per week, which is less than one third the average weekly salary for males ($1,770.30)3 and over 30,000 residents (approximately 15% of the population) living on social security in the form of an aged pension or Newstart allowance4.

Furthermore, residents have observed that Brimbank Councils seem to always set the allowances at the top end of the set range, with little to no regard or consideration of the underprivileged nature of the municipality they are managing.

Residents consider the current range of allowances to be appropriate and reflect the time and commitment required to perform the duties effectively. However, residents strongly feel that additional criteria needs to be incorporated to consider the demographic and wealth profile of the municipality and to ensure Councillors/Mayor/Deputy Mayor actually have the skills and ability to perform those required duties they are being paid for and that they do so consistently for the entire term. Residents propose that an annual review of performance by the Mayor and Councillors be implemented to encourage them to meet that required performance level on behalf of the residents.

5. Superannuation

Brimbank Councillors and Mayor already receive an amount equivalent to the Superannuation Guarantee Contribution (10% for 2021/22) above their allowances. This means in the case of the Mayor, an additional of amount of $10,000 is paid and for each Councillor an additional amount of $3,444.40 is paid for superannuation. Residents would prefer that the allowances paid are inclusive of superannuation particularly given that Brimbank Councillors and Mayor currently receive allowances within the highest Category 3 and pay themselves at the highest end within that category.

6. Proposal to address allowances paid

Resident’s support and believe it is imperative that allowances are reviewed annually, based on set KPIs for each Councillor, the Mayor and Deputy Mayor. It is important in the service of the public to incorporate and consider individual skills and qualifications, ability to effectively and competently communicate, engage with the community, advocate for the municipality, success in managing their respective portfolios, commercial and financial acumen and in the case of the Mayor, to effectively and competently garner respect within the community, lead and influence.

Residents believe if these additional criteria were incorporated in the setting of allowances, municipalities such as Brimbank would attract a higher calibre of Councillors that are qualified to perform these duties. Additionally, the Mayor/Deputy Mayor positions would more likely be filled by Councillors who possessed the skills and qualifications to perform these duties due to an increased level of scrutiny, rather than appointment by political parties as a reward.

At present there are many Brimbank residents who have spent years advocating for specific causes/issues/groups within the municipality with proven success and desire to work tirelessly for the Brimbank community without any personal gain. These people have the integrity, skills and qualifications to be excellent community advocates on Council, however Brimbank residents often lament that because they don’t belong to a political party, they do not get the opportunity to do so and the entire Brimbank community is worse off because of that.

Residents propose that a Resident’s Oversight Group be established, which would include the Council CEO, and other appropriate Council officers such as the HR manager, for example, business and community leaders, ratepayer and resident associations etc., that could oversee the annual allowance process and measure previous year’s performance based on set criteria.

This criteria by which councillors and the mayor could be measured against could include (but is not limited to) the following:

- Residents and ratepayers’ feedback – conduct annual online survey.

- Number of Council meetings attended/missed.

- Number of motions put to Council.

- Number of community group meetings attended.

- Management and performance at Council meetings, including transparency, response to community questions and willingness to share information with the community.

- Achievement of set KPIs, including budget management.

- Level of advocacy and community engagement, including through social media platforms.

- Ability to source appropriate funding for infrastructure projects.

- Understanding and adherence to relevant legislation, including Council policies, Local Government Act 2020 and 1989, Equal Opportunity Act 2010, the Local Government (Governance and Integrity) Regulations 2020 and the Victorian Charter of Human Rights and Responsibilities Act 2006.

- Independence from third parties, such as political parties and state or federal Members of Parliament.

7. Financial impact of varying allowances values for council members

Residents don’t believe that an increase in allowances can be justified at this time and would strongly advocate against any increase.

As already stated, Brimbank is not a wealthy municipality. Additionally, Brimbank has been disproportionately affected by Covid19, both in terms of the number of residents who have caught the disease and also from the numerous lockdowns and restrictions which have destroyed businesses, jobs and livelihoods.

Furthermore, Brimbank does not receive the level of state government funding for infrastructure projects which other municipalities currently enjoy. For example, the Brimbank Aquatic & Wellness Centre has attracted approximately $2 million in Victorian government funding towards this project, estimated to cost in excess of $60 million. Compare this to Victorian government funding of $46 million towards the Gippsland Aquatic Centre (total cost $57 million). This means that ratepayer funds will be overwhelmingly utilised to finance this aquatic centre, and there is no doubt that increased rates and/or less services will result. So if Brimbank ratepayers and residents cannot rely on their Councillors and Mayor to advocate successfully and source appropriate funding for infrastructure projects, in line with other municipalities, we certainly cannot support an increase in the payment of allowances to these Councillors and Mayor.

Due to these factors, residents don’t believe that an increase in allowances paid to Brimbank Councillors and the Mayor/Deputy Mayor can be justified at this time.

Brimbank Ratepayers & Residents Association, Inc.

2 https://quickstats.censusdata.abs.gov.au/census_services/getproduct/census/2016/quickstat/LGA21180

3 https://www.abs.gov.au/statistics/labour/earnings‐and‐work‐hours/average‐weekly‐earnings‐australia/

Chris Mack

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

I wish to make my Objection noted, to Any council employee or remunerated person receiving any increase in income at this time.

Chris Mack

Black Rock.

Christine Maynard

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors.

To whom it may concern

There’s no way I support the circus at the City of Yarra getting pay rises.

There’s [sic] spent more time in the headlines for all the wrong reasons instead of representing the ratepayers and residents of the city and Yarra. I’m disgusted that this is even a suggestion.

However feel free to pick up our rubbish weekly and get the rubbish out of the gutters and streets and support the local community of the City of Yarra by getting the Enabler injection room moved out of our community.

We deserve better and they don’t deserve a red cent.

(redacted)

Most of these councillors have not done a thing to help our community!!!

Have an awesome day.

Kindest Regards

Christine Maynard

Managing Director

Summer Kai

Daniel Kade

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

Proposed determination of allowances for Mayors, Deputy Mayors and Councillors

Submission from Daniel Kade

(redacted)

(redacted)

Allowances

Having Councillors that are skilled and diverse is important to achieving good community outcomes. The current allowances offered to Councillors creates a barrier to attracting skilled and diverse candidates to this vital community role, as becoming a Councillor means that one would most likely be financially disadvantaged, as those skills attract a much higher price in the labour market.

Ideally Councillors would give their attention to the role full time so that they can consider all of the information and make the best decisions possible. If Councillors must split their time with a second job to receive a livable income then this may affect the quality of decision making at Council and have long term consequences for the community.

The allowance for Councillors should be at a level that allows them to undertake the role full time and does not financially disadvantage somebody if they choose to undertake the role. The exact level of compensation should be discussed further to determine what it should be. Example amounts include:

- an amount equal to the full time minimum salary

- an amount equal to the full time average salary

- an amount equal to the full time salary at the level of skill required for the role

Having an allowance that fairly compensates Councillors for their time and effort not only removes barriers for attracting suitable candidates to stand for Council but also may reduce corruption. If Councillors are not being paid adequately by the rate payer then there may be a higher risk that they will seek income by unlawful means, e.g. making favourable decisions to developers for payment.

Superannuation is a form of income and this also should be considered as part of the allowance, if it is paid as superannuation or a loading to the allowance can be discussed further.

Financial Impacts

In the short term increasing the allowance for Councillors will increase Council expenses. However if the result is that it attracts more skilled Councillors that make better decisions then over the long term it could decrease expenses.

Role of Councillors

The role of Councillors is similar to a Board of Directors, it is to represent the interests of the owners (the community) and to ensure that the corporate systems and framework allow the organisation to achieve corporate objectives (deliver the legislated services).

East Gippsland Shire Council

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

East Gippsland Shire Council Submission

Victorian Independent Remuneration Tribunal:

Proposed Determination of allowances for Mayors, Deputy Mayors and Councillors

Executive summary

Allowances are an integral component of ensuring that Councillors can perform the roles and responsibilities outlined in the Local Government Act 2020, representing the municipal community and participating in effective and transparent decision-making. The level of allowances should reflect the commitment expected of Councillors and the financial sustainability of the Council. In addition, allowances should adequately reflect the cost of representing the community to not preclude anyone from nominating and to ensure diversity of representation. Overall, when determining Councillor allowances, consideration should be given to a broad base of factors.

Role of Council members

The Local Government Act 2020 clearly sets out the roles of a Councillor, the Mayor and Deputy Mayor in representing the interests of the municipal community. It sets a higher standard of integrity and behaviour for Council members than the Local Government Act 1989. The new Act increased the responsibilities for a Councillor and subsequently the onus on themselves to ensure they have the appropriate skills and abilities to undertake their duties.

Many elected representatives are unaware of the actual commitments required to be a Councillor beyond attending Council meetings and some civic events. The role of a Councillor may be voluntary, but the level of commitment is upward of a full-time executive.

East Gippsland Shire Council holds approximately 16 Council meetings and 48 Councillor briefing sessions per year, each with an agenda of papers and presentations that requires approximately 4-5 hours reading per week.

On top of that, Councillors participate in a range of activities including:

- briefing sessions for specific matters such as the budget, Council Plan

- Planning Consultative Meetings, as required

- section 223 hearings, as required

- advisory committee meetings (10 committees each meeting quarterly)

- representing Council on external committees (14 committees)

- community events and functions

- meetings with members of the municipal community

- training and professional development

In addition, Councillors allocate considerable time to responding to emails, letters and phone calls from members of the municipal community on a wide range of matters. These activities require considerable time commitment from Councillors to effectively fulfill their roles and responsibilities.

Following the 2020 Local Government election, Councillors in East Gippsland Shire have committed a large amount of their time to attending the required Councillor Induction Training on top of their regular commitments. Many have dedicated extra time to attend additional personal development training to enable them to effectively fulfill their roles and responsibilities. While the financial cost of training is generally covered by the Councillor Support and Expenses Policy, the Councillor’s allocation of time, plus the impact on income and family are not.

In geographically large shires like East Gippsland - which covers 10% of Victoria over 20,940 square kilometres - the time commitment is compounded by the need to travel to attend meetings or participate in events as a Councillor. As indicated by the recently released Local Government Inspectorate report1, many Councillors reported their time commitment to be in excess of 16-24 hours per week and some Mayors reported spending more than 40 hours per week undertaking their roles and responsibilities.

The East Gippsland Shire Council is an unsubdivided electorate and Councillors represent the whole municipal community across 20,940 square kilometres. The tyranny of distance provides Councillors the added challenge of allocating time for engaging with the community across the Shire. Not to mention the safety of travelling on rural and regional roads.

The time committed to the roles and responsibilities of being a Councillor have flow on effects to employment or income earning capacity for self-employed people. Those Councillors employed must negotiate time away from their employment and those self-employed have to forgo earning opportunities for considerable periods each week. The East Gippsland Shire Councillors meet for five hours every Tuesday afternoon with most meetings going beyond the allocated time and every three weeks Council meetings that may go for up to three hours and sometimes beyond. Furthermore, attendance or participation in other Council related activities during business hours will require additional time away from work.

Purpose of allowances

Allowances, whilst not a wage, should be reflective of the commitment required by the Councillor to effectively fulfill their roles and responsibilities in representing the municipal community. Councillors are required to be adequately informed in the decision-making process and therefore have the responsibility to allocate sufficient time to understand matters presented to them for an outcome.

Many decisions of Council are complex and require Councillors to balance their work, family and life commitments with that of being a Councillor. If a Councillor, as indicated in the Local Government Inspectorate report, is spending in excess of 16-24 hours in their voluntary capacity as a Councillor and undertaking a 38–40-hour work week, the impact on their work/life balance can be significant.

Allowance category factors

Allowance category factors should reflect the demographics for the type of municipal community. For example, the demographics of an interface municipality will be different to that of a large shire or even a regional city council.

A key factor in determining allowances is the affordability and sustainability for the ratepayers. Councils need to balance the quantum of allowances to ensure Councillors are sufficiently compensated for their commitment with the potential impact on the delivery of services to the municipal community. Councils can only raise revenue from limited sources and given the current capping on rates, the opportunity to grow the income base of Council is restricted.

In the current methodology, population is used to determine the current Councillor allowances. While this reflects the level of services that Council must provide to the municipal community, it does not reflect the income base. Not all residents are ratepayers. In addition, in the East Gippsland Shire a significant number of ratepayers do not live in the municipality for a variety of reasons including investment in holiday homes.

Consideration should be given to broadening the basis for determining allowances as additional factors impact the Council’s ability to deliver services and maintain a sustainable financial situation. Other factors that could be considered include:

- geographical spread of the Shire

- economic factors such employment trends, economic growth

- industry composition

- social factors

- environmental factors

- circumstances such as drought, bushfire, flood and the pandemic

- provision of services.

The current factors are relatively easy to apply, but do not necessarily reflect the social, economic or environmental fabric of the municipality.

Adequacy of allowances

East Gippsland Shire Council has historically set the maximum amount of allowances in category 2 for the Mayor and Councillors. As outlined in the Local Government Inspectorate report, some East Gippsland Shire Councillors have indicated that the allowances do not reflect the commitment and cost of being a Councillor. Consideration should be given to determine allowances that reflect the commitment and financial and personal costs to Councillors in light of the legislative requirements in the Local Government Act 2020 and other Acts administered by Council.

The amount of Remote Travel Allowance has not changed since 2008 and is not reflective of the cost of travel in rural and remote communities. The Remote Travel Allowance is currently claimable by Councillors who reside greater than 50 kilometres from the location of a Council meeting or function. Consideration should be given to ensuring the Remote Travel Allowance reflects the current cost of travel in rural and remote areas whilst providing an annual cap. Clarity is required about whether this allowance is payable if Council provides the Councillor with a vehicle.

Allowances should also reflect the role and responsibilities of positions held on Council, such as the Mayor and the Deputy Mayor. The Local Government Act 2020 provides for greater responsibilities for the Mayor beyond chairing the meeting and attending functions. The allowances should reflect the responsibilities and additional time commitment for undertaking the role.

Currently there are no allowances specific to the Deputy Mayor, however consideration could be given to enabling the payment of allowances, like a sitting fee, when the Deputy Mayor assumes the role of Mayor in their absence. A sitting fee arrangement would reflect the increased responsibilities at a point in time.

Allowances that are too low may discourage candidates from seeking to run as a candidate in a local government election because of the life balance forgone. This will affect the ability of the community to elect representation that reflects its demographics. In addition, this has the potential to prevent people with relevant skills, knowledge and passion from nominating to be a Councillor.

In addition, low allowances limit the ability of people in different stages of life contributing to municipal life, as they may not have the capacity to fund reduced income from their primary employment, particularly self-employment. Allowances should provide some compensation for forgone income to enable Councillors to represent the municipal community.

People should not be prevented from being a Councillor due to the impact on their income or because they cannot afford it. Allowances that are too low to compensate the commitment required from a Councillor have the potential to discriminate on age, gender, ethnicity and other demographics. For instance, a young person early in their career may not be able to negotiate the interruption to their work with their employer or a person looking to start a family may not be able to afford the interruption to their income.

Allowances that reflect the true cost of representing the community will attract a greater diversity of candidates for the community to consider and elect to represent the municipal community.

Superannuation

East Gippsland Shire Council pays an amount equivalent to the Superannuation Guarantee to Councillors. The impact of paying this contribution should be considered in determining quantum for Councillor allowances as this still needs to be accounted for in the Council’s budgeting.

Comparators

Consideration should be given to lessons learnt from other jurisdictions in the determination of allowances, as this will provide information relevant to broadening the scope for the basis for Councillor allowances in Victoria. Drawing on the experiences of other states in determining Councillor allowances will provide assurance to the municipal community that the allowances reflect the demographics of the Shire and the financial sustainability and commitment of Councillors.

In addition, experiences for determining allowances or sitting fees for boards such as regional health organisations, sporting organisations and other community-based groups should be reviewed.

Financial impacts

Allowances established by the Victorian Independent Remuneration Tribunal should reflect the financial sustainability and the operating environment of the Councils, particularly the ability to grow the rates basis for the Council. Further, consideration should be given to the social, economic and environmental situation of a shire. This is particularly relevant to East Gippsland where the community has been impacted by drought, the 2019/20 summer bushfires and a pandemic in quick succession.

In essence, the financial situation of a Council may not be reflective of their state’s overall financial situation and consideration should be given to this when determining Councillor allowances.

1 Local Government Inspectorate, Councillor Expenses and Allowances, September 2020

Frank Donato

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

I will loose $100000 in taking over this current 3 week lockdown Thinking of returning to becoming a public servant Regards Frank Donato B.Ag.Sc.,Dip.Ed Donato cafe Mt Martha

Graham Jolly

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

Victorian Remuneration Tribunal committee.

I make this submission to object to any increases in remunerations to all Councillors, Mayors and Chief Executive Officers in all 79 Local Governments of Victoria for a period of the next 4 years. 2022‐2026.

I give reasons why I object.

1. Victoria and it’s ratepayers are going through extended periods of financial hardship brought about by the COVID‐19 virus progressive outbreaks, especially this DELTA strain and the continued lock downs.

2. Live‐streaming of council meeting set down by the Victorian Government.

3. Continued poor outcome performances by councils which continues every year. Reference my councils third quarterly financial report and its Capital Works Projects results at the rear of the report. Note forecast Carryovers, Investment level and the Comprehensive Income Statement.

I request this Remuneration Tribunal to use as evidence a number of public reports spanning the last 4 years and points (a. to I.) I provide in this submission.

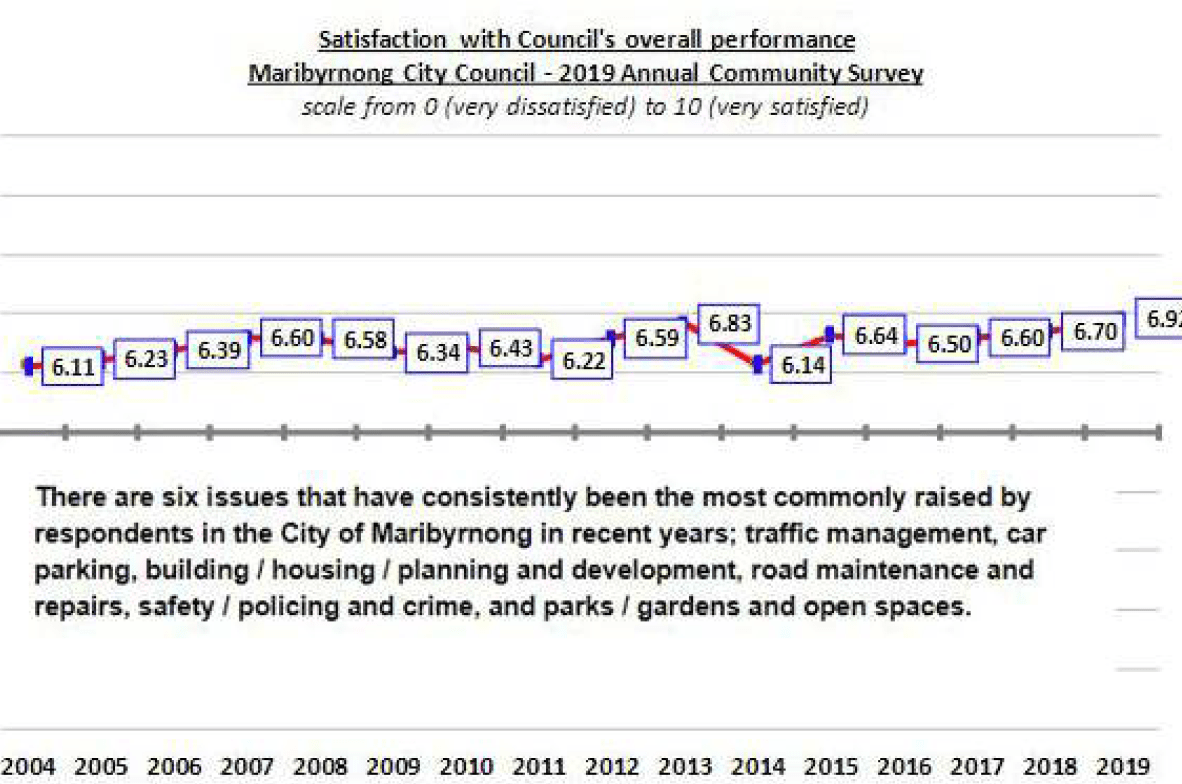

a. Local Governments Community Satisfaction survey results which clearly shows a disconnect councils have to its paying ratepayers.

b. Victorian Auditor Generals Annual reports for Local Government’s of which VAGO is restricted and limited in what can and cannot be reviewed and reported.

c. The Victorian ‘Know Your Council’ local government review report which has failings as their is no details of financial Carryovers of Capital Works and the percentage numbers of Capital Works Projects as a measure of actual achievements.

https://knowyourcouncil.vic.gov.au/councils/bass‐coast

d. The Local Government Act 2020 has no Section or subsection stating a requirement of a Chief Executive Performance Policy with sub sections for financials, financials of Capital Works and measures of project infrastructure outcomes.

Section 46 and Section 106 of the LGA 2020 is quite clear what the CEO of council must do but no performance measures or Key Performance Measures.

e. The LGA 2020 has no Section or subsection stating requirements of Councillors and Mayors Performance Policy as measures of Statutory requirements and budget achieved outcomes.

https://www.legislation.vic.gov.au/in-force/acts/local-government-act-2020/003

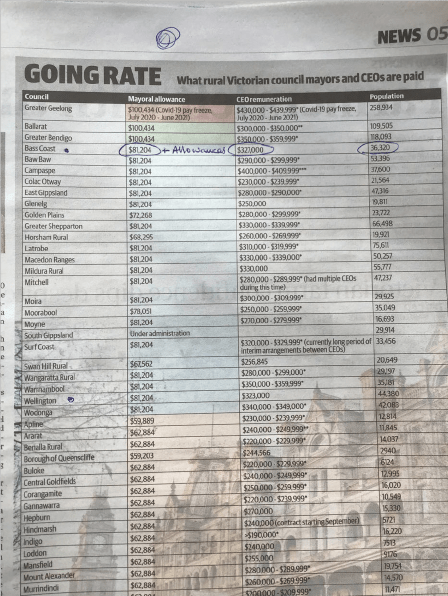

f. My council, the Bass Coast Shire Council (Councillors) voted and approved wage increases to the maximum allowed set down by the Victorian State Government on 17 February 2021 during a COVID-19 hardship period.

The review of Councillor Allowances 17/2/2021 was allowed under the Local Government Act 1989 Sections 73B and 74 to 74B and section 74(1). The Bass Coast Shire Councillors prior to voting received no public submissions. The approval outcome was for Councillors to receive a maximum of $26,245 with a 9.5% superannuation guarantee and the Mayor a maximum of $81,204 with a 9.5% superannuation guarantee.

Refer to H.12 page 180 of the Ordinary Council meeting 17 February 2021.

g. As part of the remuneration allowances for Councillors and Mayors of the Bass Coast Shire Council 9 councillors can claim at will with proof for Car Milage expenses, Conferences and Training expenses, Information and Communication expenses, Travel expenses and Vehicle expenses all through a period of the COVID-19 virus periods of lock down and while live-streaming Zoom meetings are allowed.

h. The Chief Executive Officer of the Bass Coast Shire Council remuneration is $327,000 per annum. However little is known about any allowances attached as the councillors declared the details confidential.

I. Councils investments are high and financial Carryovers of Capital Works Projects are low. Both a measure of poor performance by my council the Bass Coast Shire Council and all 79 Councils in Victoria.

It is my intention that my submission must be strongly taken into consideration leading to a conclusion of NO increases in any remuneration should be allowed under your consideration.

Not even an inflation increase or any percentage increase of any limit.

Yours Sincerely

Graham Jolly

James Bae

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

Hi,

We do not believe Mayors and Councillors should receive an increase in their remuneration. They are honorary positions in our community, and the increases would defeat these purposes.

I, on behalf of Korean communities in Victoria, express strong dissent on such increases.

James

Kelly Rossiter

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

I wish to object to an increase in the allowances and renumeration for Mayors and councillors.

We are in a pandemic and there should be no increase. An increase simply doesn't meet community standards in these dire ecomonic condirions.

The community is struggling. Businesses are going bust due to no fault of their own. Many in the community are struggling both financially and mentally.

In these trying conditions, to award increases to Mayors and councillors allowances would send the wrong message. Those who continue to hold onto their jobs should be grateful.

These are not normal times. The public is struggling and the fact that the public pay the allowances for Mayors and councillors should not be forgotten.

Regards.

Margaret Quon

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

My submission states I do not wish to see any pay rises in local government. In fact a review of pay structures is required to show accountability of CEO's , Mayors , Deputy Mayors and Councillors. The Shire of Yarra Ranges pay rate for these Office bearers appears excessive for little return or outcomes. During the pandemic council and local government have reduced services and were very slow to respond to needs of residents following a huge storm.

Pay rises are only valid when those in the roles or the whole organisation is performing at a peak.

keep smiling

Margaret Quon

Marion Attwater

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors.

15th August 2021

Dear Chairperson and Tribunal members,

Re: Proposed determination of allowances for Mayors, Deputy Mayors and Councillors ‐ submission

Thank you for the opportunity to make a submission to this process.

As a resident of the City of Moreland, and having attempted to be involved in local council issues and consultations during the past few years, my opinion is that:

- Councillors allowances should be increased significantly

- Mayors and Deputy Mayors allowances should be decreased significantly

I note that elected parent members of Government School Councils are unpaid. They volunteer their time for free. In my opinion, children deserve better than that, and there should be consideration of the bigger picture, and redistributing funds more evenly across society.

Local Councillors are definitely paid too little, and my observation is that the administration takes advantage of that by writing long rambling reports and producing monthly meeting agendas that are sometimes over 1,000 pages long. Council staff are therefore able to hide numerous details in these long agenda that are rarely picked up by Councillors, who for $31,000 per year could not be reasonably expected to read more than the Executive Summary of each item in the Agenda.

Actually even the Executive Summaries tend to be very badly written with numerous deliberate omissions, with Officer Recommendations that do not fulfil the requirements for properly constructed resolutions of Council (e.g. are not self‐contained and self‐explanatory, but instead are vague and open to misinterpretation).

It is the salaries of the Council staff that need to be seriously reviewed, and drastically slashed.

The Mayors allowance is too high, (redacted), in an extremely embarrassing Special Meeting to elect the Mayor and Deputy Mayor.

And then to make matters worse, the Mayor and a select group of Councillors elected themselves to a Committee to oversee the development of the 4-year Council Plan and other key Council strategies, and via that Committee they then delegated the responsibility for community engagement to consultants, at an extravagant and wasteful cost.

So instead of the Mayor fulfilling their role as per section 18(1)(c) of the LGA 2020, to "lead engagement with the municipal community on the development of the Council Plan", they have instead handed over that job to Council staff and consultants. I am aware that some of the deliberative engagement consultants charge $400 per hour. I have noticed that there are 3‐4 deliberative engagement consultant specialists who appear to be producing the Council Plan for many metro Councils this year.

(redacted)

I gave up submitting questions to public question time for quite a while after that, because I felt that I was knowing causing disinformation to be published in the governance report section of the monthly meeting agenda. And that was not my intention.

I have also noticed that the Mayor is not sufficiently familiar with the Governance Rules, and does not implement meeting procedures in a sufficiently reasonable manner compared to the allowance that they are paid.

I would also point out that Moreland Council has not yet even produced a Draft Council Plan or Draft Council Vision, even though it is the middle of August. There is no Council Action Plan for 2021–22 either.

My impression is that governance standards have dropped significantly under this new LGA.

Therefore for all the reasons mentioned above, I believe that the Mayoral allowance should be reduced significantly.

Thank you for the opportunity to make this submission.

Yours faithfully,

Marion Attwater

(redacted)

Mio Ihashi

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

Dear sir or madam

I’m writing to express that I do NOT want increases in councillor and mayor allowances.

Regards

Mio Ihashi

Moonee Valley City Council

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

Submission in response to the consultation paper, Proposed Determination of allowances for Mayors, Deputy Mayors and Councillors

Submitted by Moonee Valley City Council

16 August 2021

localgovernment@remunerationtribunal.vic.gov.au

For any enquiries, please contact: Ms Helen Sui

Chief Executive Officer

(03) 9243 8855 / hsui@mvcc.vic.gov.au

Moonee Valley City Council

9 Kellaway Avenue Moonee Ponds

PO Box 125 Moonee Ponds Victoria 3039

DX 212139

Phone 03 9243 8888 Fax 03 9377 2100 Email council@mvcc.vic.gov.au

mvcc.vic.gov.au

Introduction

Moonee Valley City Council is pleased to have the opportunity to provide feedback in response to the Victorian Independent Remuneration Tribunal’s consultation paper, Proposed Determination of allowances for Mayors, Deputy Mayors and Councillors. We welcome this process of independent review as an opportunity to establish allowances for Councillors, Deputy Mayors and Mayors which reflect the important role these elected representatives play in providing good governance, and as the closest level of Government to our Victorian communities.

About the City of Moonee Valley

Moonee Valley is located in the inner and middle north-western suburbs of Melbourne, between four and 13 kilometres from the CBD. Approximately 131,000 people call Moonee Valley Home. This is forecast to grow to 177,000 by 2041. While our community is ageing, there will also be more young professionals and the regeneration of families by 2040.

Moonee Valley is proud of its rich heritage. The Wurundjeri Woi-wurrung are the traditional owners of the land. They relied on the Maribyrnong River, Moonee Ponds Creek and Steele Creek for fishing, transport and food. Our history goes back a long way, and continues to live through family stories, buildings, residential and commercial precincts, parks, trees and objects.

Almost one-third of our population was born overseas, and around 30 per cent speak a language other than English at home. While diversity is a major strength for Moonee Valley, health and wellbeing outcomes can be quite different for different groups. Moonee Valley can be described as a ‘tale of two cities’, with those who are relatively advantaged and disadvantaged living in close proximity. Our municipality has eight of the top 24 most disadvantaged small areas in Victoria in terms of socio-economic disadvantage. We also have the third-highest proportion of social housing dwellings in Victoria, with major housing estates in Flemington and Ascot Vale.

Moonee Valley is also home to major employment precincts including Essendon Fields/Essendon Airport.

In 2018, Moonee Valley published our long-term plan, MV2040, which guides how we will make Moonee Valley a great place to live for current and future generations. Under this Strategy, we’re working toward a Moonee Valley which is Fair, Thriving, Connected, Green and Beautiful.

Submission

The Tribunal has asked that respondents refer to a set of consultation questions. We address these below.

Role of Council members

1. What are the most important duties and responsibilities of Mayors, Deputy Mayors and Councillors?

The role of the Mayor, Deputy Mayor and Councillors are outlined at sections 18, 21 and 28 of the Local Government Act 2020. Specifically, they are:

s18 Role of the Mayor

(1) The role of the Mayor is to—

(a) chair Council meetings; and

(b) be the principal spokesperson for the Council; and

(c) lead engagement with the municipal community on the development of the Council Plan; and

(d) report to the municipal community, at least once each year, on the implementation of the Council Plan; and

(e) promote behaviour among Councillors that meets the standards of conduct set out in the Councillor Code of Conduct; and

(f) assist Councillors to understand their role; and

(g) take a leadership role in ensuring the regular review of the performance of the Chief Executive Officer; and

(h) provide advice to the Chief Executive Officer when the Chief Executive Officer is setting the agenda for Council meetings; and

(i) perform civic and ceremonial duties on behalf of the Council.

s21 Role of the Deputy Mayor

The Deputy Mayor must perform the role of the Mayor and may exercise any of the powers of the Mayor if—

(a) the Mayor is unable for any reason to attend a Council meeting or part of a Council meeting; or

(b) the Mayor is incapable of performing the duties of the office of Mayor for any reason, including illness; or

(c) the office of Mayor is vacant.

s28 Role of a Councillor

(1) The role of every Councillor is—

(a) to participate in the decision making of the Council; and

(b) to represent the interests of the municipal community in that decision making; and

(c) to contribute to the strategic direction of the Council through the development and review of key strategic documents of the Council, including the Council Plan.

(2) In performing the role of a Councillor, a Councillor must—

(a) consider the diversity of interests and needs of the municipal community; and

(b) support the role of the Council; and

(c) acknowledge and support the role of the Mayor; and

(d) act lawfully and in accordance with the oath or affirmation of office; and

(e) act in accordance with the standards of conduct; and

(f) comply with Council procedures required for good governance.

(3) The role of a Councillor does not include the performance of any responsibilities or functions of the Chief Executive Officer.

As these roles are enshrined in legislation, each is equally important and forms part of the community’s expectations around the performance of the Mayor, Deputy Mayor and Councillors.

2. How have the roles and responsibilities of Council members changed since the last review of Councillor allowances in 2008? What future challenges may emerge?

As the Tribunal is aware, in recent years the Local Government Act underwent its “most ambitious and comprehensive reform… for 30 years,”1 culminating in the adoption of a new Local Government Act in 2020. This has resulted in significant shifts to the roles and responsibilities of Councillors, as well as expectations around Councillor capability and accountability. These are positive reforms, which Moonee Valley has supported at every stage. From our first submission to consultations held around reform of the Local Government Act, we championed the need for training to support all Councillors to fulfil their governance responsibilities. We therefore welcome the fact that training of Council candidates and new Councillors is now mandatory, as outlined at sections 32 and 256(7) of the Local Government Act 2020. With additional responsibility and capability required of Councillors under the new Act, it seems appropriate that the Tribunal review Mayor, Deputy Mayor and Councillor allowances to determine whether an increase is also warranted.

The consultation paper notes the impact of increasing use of digital methods of communication on increased Councillor workload. The Local Government Inspectorate’s Councillor expenses and allowances paper (2020) observes that surveyed Councillors commonly commented on the need for additional administrative and secretarial support. At Moonee Valley, Councillors are resourced with support from Councillor Support Officers together with a Council Liaison Officer, who assist to respond to enquiries from the community. However, we note that this is not the case at every Council. Councillors are still responsible for responding to all of their own mobile telephone calls, responding to emails directly, and triaging any enquiries through Councillor Support and Councillor Liaison. These tasks are in addition to Councillors’ governance and public-facing roles, such as preparing for and attending Council Meetings, attending officer briefings, participating in committees, attending community gatherings, and so forth. At other levels of Government, elected representatives receive administrative support (through electorate officers and the like) to attend to tasks of this nature.

Use of social media has also increased the ease with which the community is able to communicate with Councillors. Many Councillors maintain their own independent social media platforms (Facebook, Instagram, Twitter and LinkedIn being the most popular) which Council officers do not support them to administer. Submissions to the Victorian Parliament’s Inquiry into the Impact of Social Media on Elections and Electoral Administration noted the increased workload for Councillors that has come as a result of the rise of social media, and the impact of negative feedback/”trolling”.

The consultation paper also notes the impact of population increases. As the introduction to this submission noted, the population of Moonee Valley is expected to grow from its current figure of approximately 131,000, to 177,000 by 2041. With this growth comes increased service provision, increased infrastructure delivery and increased demand on the planning process.

These are all factors which should be taken into account by the Tribunal.

3. How are Council member roles affected by a Council’s electoral structure (for example, ward structure or ratio of Council members to population)?

Moonee Valley currently has a multi-member ward structure. Our municipality is divided into three wards: Buckley (Aberfeldie, Essendon Fields, Essendon North, Strathmore, most of Essendon and Strathmore Heights, parts of Moonee Ponds and Essendon West); Myrnong (Ascot Vale, Flemington, Travancore, most of Moonee Ponds, part of Essendon) and Rose Hill (Airport West, Avondale Heights, Keilor East, Niddrie, most of Essendon West, part of Strathmore Heights). At the time of the 2020 Council elections, voter enrolment in Buckley Ward was 29,608, in Myrnong Ward was 32,010, and in Rose Hill Ward was 32,305.2 We will transition to a single-member ward structure at the 2024 Council elections, along with remaining metropolitan Councils who did not move to single-member wards in 2020, in line with section 13 of the Local Government Act 2020.

It is difficult to predict with any degree of certainty what the impacts of these changes will be to Councillors’ workloads. The purpose of uniform single-member ward structures articulated by the then-Minister for Local Government was to provide greater “accountability, equity and grassroots democracy”. A multi-member ward structure results in a larger number of community members to represent, but alongside that is the potential to share the workload with fellow Councillors representing the same constituency. As the sole representative of a suburb or equivalent area, a Councillor’s workload may increase, even though the total number of people represented has decreased.

Regardless of ward size, Councillors, the Deputy Mayor and the Mayor “represent the interests of the municipal community” in their decision-making, as required under section 28(2) of the Local Government Act 2020. This means that every Councillor, while elected by a constituency defined by ward boundaries, ultimately serves the entire municipal community. Regardless of municipal structure, every Councillor, Deputy Mayor and Mayor is required to perform the same role as defined under the Act, outlined in our response to Question 1. These are factors the Tribunal should take into account when evaluating whether municipal structure is the right measure to apply in determining allowance levels

Purpose of allowances

4. What is, or should be, the purpose of allowances for Council members?

In his letter to the Tribunal, the Minister reflected that while “Government [currently] views Councillor allowances not as a form of salary, but as a recognition of the contributions made by those elected to voluntary part time roles in the community, the Tribunal may wish to consider whether this view supports a contemporary local government sector that attracts diverse community perspectives to civic life”. We welcome the Minister’s commentary that the current purpose of allowances, which is not outlined in legislation, requires revisiting and redefining.

The Local Government Inspectorate’s Councillor expenses and allowances (2020) report indicated that many surveyed Mayors viewed their allowance as a form of salary, regarding the role of Mayor as being either full-time or close to full-time in nature. A majority of Councillors, by comparison, hold down other work alongside their Councillor role. This necessarily impacts the amount of time individuals are able to dedicate to the role of Councillor, and may dissuade prospective candidates with other work and care responsibilities from nominating for Council. The Inspectorate’s report noted that a majority of surveyed Councillors viewed the purpose of allowances as being to “represent recognition of the contributions” made by Councillors, or to “cover costs relating to” the role of Councillor. This second response, which was selected by 35 per cent of surveyed Councillors, should ultimately be the purpose of the Councillor Expenses policy and processes.

Councillor allowances should ideally act as a form of remuneration or compensation for the work done by Councillors, taking into account the community’s expectations of Councillors, the average hours Councillors report working, and the seniority of their public role in the community.

Allowance category factors

5. What factors should be considered when allocating Councils to allowance categories? Is the existing system, in which Councils are allocated categories based on population and revenue, appropriate?

As we have noted previously, every Councillor, Deputy Mayor and Mayor is required to perform the same role as defined under the Act. Given that Mayors, Deputy Mayors and Councillors ultimately all perform the same legislated role, it is challenging to identify an appropriate system of categorisation which allocates greater allowances to some Victorian Councillors and Mayors, than it does others. Each Council has its own unique set of challenges and opportunities which must be acknowledged.

Adequacy of resources

6. Are current allowance values adequate, for example to:

a. Attract suitable candidates to stand for Council?

b. Reflect the costs (e.g. time commitment) and benefits of Council service?

c. Support diversity amongst Council members and potential candidates?

The Tribunal is aware that in the past, Councillor and Mayoral allowances have been set by the Minister, utilising a three-tier approach based on the Council’s income and population. The lowest band, which applies to small regional Councils, sets Councillor remuneration as low as $8,833 per annum plus the equivalent of the superannuation guarantee.

Moonee Valley City Council is currently a Category 3 Council. This means that our Councillors are entitled to receive an allowance of between $13,123 - $31,444 p/a and our Mayor is entitled to receive an allowance up to $100,434. Both the Mayor and Councillors also receive the equivalent of the superannuation guarantee of 10.0 per cent. At its Meeting of 11 May 2021, Council reviewed its allowances in accordance with section 74(1) of the Local Government Act 2020. Council determined at that time to set its allowances at $31,444 for Councillors and $100,434 for the Mayor, placing us at the top of the current band.

The Tribunal notes in its consultation paper that according to research conducted by the Municipal Association of Victoria (MAV), Councillors generally spend between 10 to 20 hours per week on their role. Applied as a salary, a Moonee Valley Councillor working 20 hours per week would be paid $30.23 per hour. At the lowest possible Category 1 rate of $8,833 per annum, a Councillor working 20 hours per week would receive $8.49 per hour. Many Councillors estimate that they work significantly more than 20 hours per week; as the consultation paper notes, 20 per cent of respondents to the Local Government Inspectorate’s Councillor expenses and allowances report (2020) indicated that they spent more than 32 hours per week in the performance of their role.

Whilst we appreciate that the allowance structure is not intended to mimic a salary, the current allowance paid to Councillors does not seem sufficient in recognition of the significant responsibilities they hold. As the closest level of Government to the community, Councillors are extremely accessible, their mobile telephone numbers and email addresses publicly provided. It is entirely appropriate that Councillors continue to maintain the level of accessibility they currently have to the community. However, their allowance should be set in recognition of this level of accessibility, and the tasks they perform.

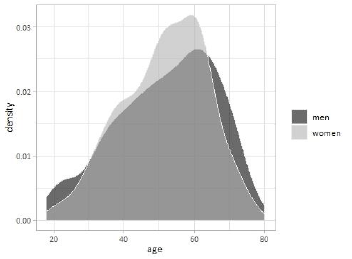

The allowance provided to Councillors undoubtedly impacts on willingness to stand for Council, and on Councillor diversity. Moonee Valley acknowledges that the Victorian Government is currently implementing a range of measures to encourage greater diversity in Local Government representation, and in particular a greater number of women to stand for election to Local Government. This includes the adoption of the Gender Equality Act 2020 and the establishment of a Gender Equality Advisory Committee. Moonee Valley is proud to have a strong history of encouraging women’s participation in Local Government, evidenced by the fact that this is the third Council term in a row where we have a majority female Councillors, and in the immediate past two Council terms, seven out of eight of our Mayors were women. Our current Mayor stated in his acceptance speech that he is proud to be the first openly-identifying member of the LGBTIQA+ community to be elected Mayor of Moonee Valley City Council. We strongly support diverse representation in Local Government in all its forms.

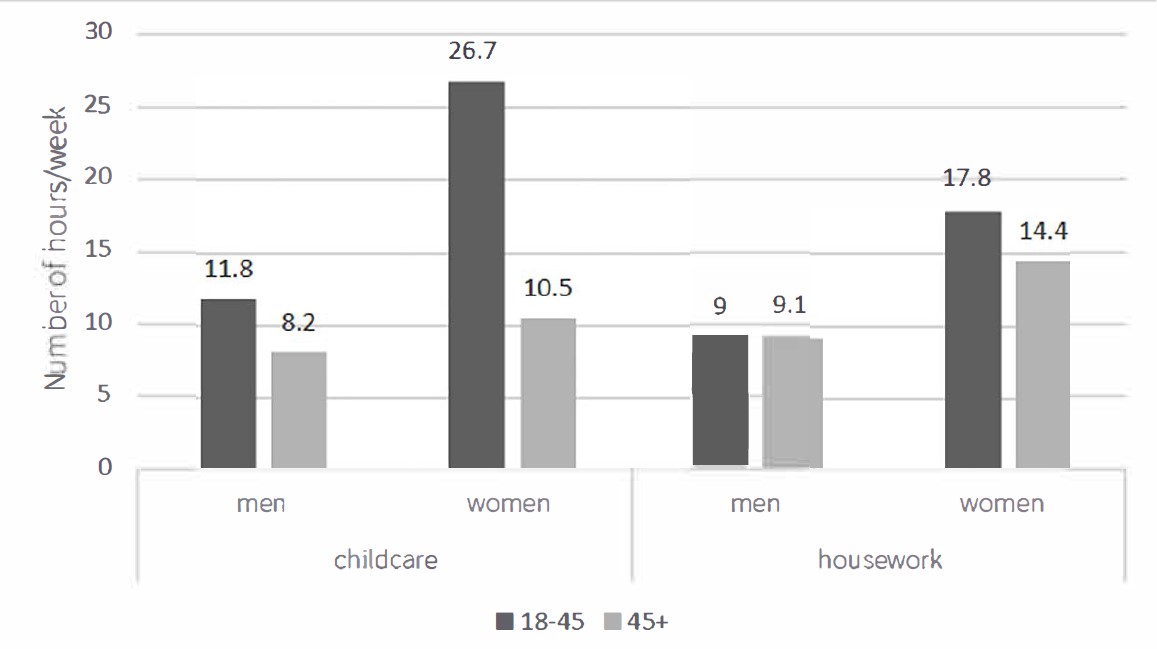

We are concerned that responses to the Local Government Inspectorate’s Councillor expenses and allowances report (2020) suggest that there are still barriers to participation for Councillors from diverse backgrounds, including financial barriers. We note that close to 60 per cent of surveyed Councillors indicated that they felt they were not paid enough. When asked what kinds of things respondents thought the Councillor Expenses policy should cover/that they should be reimbursed for, less than 50 per cent of Councillor respondents selected “Childcare and other dependent care related expenses”. Neither response was aggregated by gender; noting that responses to the MAV Councillor Census (2017) showed that around half of all female respondents had care responsibilities for children and/or dependents, compared to less than 30 per cent of all male respondents. The report went on to highlight a negative example of a Councillor making childcare and dependent care expense claims, and to draw on a positive example of Councillor expense reporting where no Councillor claimed childcare or dependent care expenses.

Whilst the Local Government Act 2020 has seen the introduction of explicit provisions to ensure Councillors are supported with care-related expenses (section 41) as well as accessibility supports (section 42), reporting these costs as Councillor Expenses remains problematic, due to the not insignificant public scrutiny attached to Councillor allowances and expenses. It is clear from the Local Government Inspectorate’s survey that there are still mixed views about care-related expenses, even amongst Councillors. Support for a cultural shift is required to ensure allowances and expenses adequately support and encourage Councillors from diverse backgrounds.

Whilst Moonee Valley City Council has a female majority, including those with children, no Councillors currently tap into this allowance. We would argue the scrutiny attached to expenses if child care is included could be a large barrier to participation for some potential Councillors.

Superannuation

7. How, if at all, should superannuation be considered in determining allowance values?

A superannuation equivalent should be paid to all Councillors.

At Moonee Valley, Councillors are provided with options in regard to the administration of their allowance payments. Some receive their allowance as a direct payment in full, including the superannuation equivalent guarantee; others have nominated to have their allowance processed through payroll, with PAYG tax deducted and superannuation paid to their nominated account. This approach was implemented by the current Council at its Meeting of 23 February 2021, in line with section 446-5 of the Taxation Administration Act 1953 (Cth).

We agree with the Tribunal’s comment in the consultation paper that “superannuation arrangements for Council members are complex”. We would welcome a simplification of approach which still ensures that Councillors receive a superannuation equivalent.

Comparators

8. The Tribunal is required to consider allowances for persons elected to ‘voluntary part-time community bodies’ when making the Determination. Which bodies should the Tribunal consider, and why?

Moonee Valley does not have a view in response to this question.

9. The Tribunal is also required to consider similar allowances for elected members of local government bodies in other States. Which States are particularly relevant (or not) for this purpose, and why?

The Tribunal’s consultation paper notes that the States of New South Wales, Queensland, South Australia and Western Australia all consider “social, economic and environmental factors” in determining allowance categories. The States of New South Wales, Queensland and Western Australia also factor the extent of services provided. Without having reviewed each State’s approach in detail, these approaches appear to have merit, and we would be interested to see service delivery and social, economic and environmental factors incorporated into the Tribunal’s determinations.

Financial impacts

10. What are the financial impacts of varying allowance values for Council members?

Allowances for the Mayor, Deputy Mayor and Council are paid for as part of Council’s operating budget. In this regard, we are subject to the determination of the Tribunal and will be required to adjust our Budget accordingly. The introduction of rate-capping of Victorian Local Governments in 2015 has restricted our budget envelope, and we note that increases in Councillor allowance will need to be balanced elsewhere in the Budget. There are also community expectations around the amount of rates revenue which should be expended on Councillor allowances and expenses, which must be measured. Nevertheless, we support appropriate increases in recognition of work performed, for the reasons already outlined.

Conclusion

Moonee Valley City Council thanks the Victorian Independent Remuneration Tribunal for the opportunity to provide feedback in response to its discussion paper, Proposed Determination of allowances for Mayors, Deputy Mayors and Councillors. We look forward to the outcome of this review.

Should you wish to discuss any of these matters further, please contact:

Ms Meghan Hopper

Senior Coordinator, Advocacy

(03) 9243 1127 / mhopper@mvcc.vic.gov.au

or

Ms Helen Sui

Chief Executive Officer

(03) 9243 8855 / hsui@mvcc.vic.gov.au.

1 Local Government Victoria, Local Government Act 2020,

https://www.localgovernment.vic.gov.au/council-governance/local-government-act-2020

2 Victorian Electoral Commission, Moonee Valley City Council election results 2020, https://www.vec.vic.gov.au/results/council-election-results/2020-council-election-results/moonee-valley-city-council

Municipal Association of Victoria

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors

Municipal Association of Australia

Level 12, 60 Collins Street Melbourne

GPO Box 4326 Melbourne VIC 3001

T [03] 9667 5555

F [03] 9667 5550

www.mav.asn.au

20 August 2021

Mr Warren McCann

Chair

Victorian Independent Remuneration Tribunal

Suite 1, Ground Floor

1 Treasury Place

EAST MELBOURNE VIC 3002

Delivered by email to localgovernment@remunerationtribunal.vic.gov.au.

Dear Mr McCann

Determination of allowances for Mayors, Deputy Mayors and Councillors

Thank you for the opportunity to make a submission about the Consultation Paper regarding the proposed Determination of allowances for Mayors, Deputy Mayors and Councillors.

The Municipal Association of Victoria (MAV) is a membership association and the legislated peak body for local government in Victoria.

The MAV considers the Tribunal’s review process will bring renewed public transparency to the issue of councillor allowances given a review of these allowances has not occurred since 2008. The MAV acknowledges, in addition to the Consultation Paper, there has been an opportunity for currently serving Mayors, Deputy Mayors and Councillors to complete an online questionnaire.

Councillors, as civic leaders, make a vital contribution to Victoria by representing and engaging with their communities. The duties and responsibilities of Councillors require they govern for today across the social, economic, environmental and cultural domains in the knowledge their decisions are made in stewardship for future generations.

Providing an allowance to Councillors is a recognition of the contribution they make as they perform their roles. The allowance is not the equivalent to remuneration for a salaried position. The current allowance levels do not go anywhere near the time and effort invested by Councillors in their role.

To assist Councillors to undertake their role the allowance is complimented through the provision of resources and facilities, such as information technology equipment (including mobile phone and computer) and the reimbursement of expenses, such as travel and child care/family care costs. These resources, facilities and reimbursements contribute to maximising the potential for all members of the community to seek out an elected role. In addition, learning and development opportunities are often available to assist Councillors to perform their role. As detailed in the Consultation Paper, Councillors are entitled to receive payments in lieu of superannuation entitlements and remote area travel arrangements. These payments are supported and in the view of the MAV, should be retained in their existing form.

The Local Government Act 2020 requires Councillors to represent the interests of the municipal community in their decision making. The allowance is a way to attract candidates with a diverse range of backgrounds. This diversity in backgrounds assists Councils to make decisions in the best interests of the whole community.

Since the review of allowances occurred in 2008 the roles and responsibilities of Councillors have changed and evolved. The decisions Councillors make are often long term and strategically focused across many areas including asset management, financial and corporate planning. Councillors make these decisions following more rigorous community engagement processes for which they play a key role. Since 2008 community expectations of the role has also changed especially regarding visibility, accountability and accessibility. This has partly been driven by the widespread use of technology for regular communications such as email and social media.

The role and responsibilities of the position of Mayor has particularly changed since 2008. While the Mayor continues to be the ‘leader among equals’ whose role and responsibilities include chairing council meetings, being the primary spokesperson and carrying out civic and ceremonial duties it also now includes other prescribed leadership functions such as to facilitate good governance practices including community engagement activities, dispute resolution, leading the review of the performance of the CEO and assisting their fellow Councillors to understand their roles.

In addition, the demise of traditional media outlets in communities, such as local newspapers, has resulted in Mayors having to take a greater role in filling the communication vacuum. This has been demonstrated during the COVID pandemic and recent bushfires where Mayors have often been central to communication messages by providing information and support directly to their communities through Council and other communication channels.

A recent change to roles and responsibilities of Councillors has also been the recognition of the Deputy Mayor position in the Act. Given this recognition it would be consistent practice to provide a specific allowance for this position. At the MAV State Council meeting in May 2021 a resolution was passed to ‘…allow Councils to determine a separate allowance for the Deputy Mayor role for 2021/22, subject to a Determination by the Tribunal’.

Regarding the future, an opportunity which may emerge for Councillors in undertaking their role is in respect to the new provision in the Act which enables joint meetings of councils to be held. This provision may provide new opportunities for joint decision making in areas such as procurement arrangements and creating broader strategic planning opportunities such as regional infrastructure planning.

Continuing to base the allowance categories on population and revenue is supported. The current methodology provides a consistent and transparent approach. However, it is noted additional factors (eg. geography) are considered by some other jurisdictions when determining the allowance categories. The MAV would welcome further consultation on any new methodology identified by the Tribunal.

Regarding financial implications, the setting of the allowances and the yearly increases present difficulties for Councillors given the rate capped requirements and fiscal constraints councils operate within. However, despite these difficulties the importance of the payment of the allowance remains a crucial recognition of their role and responsibilities.

In summary the MAV welcomes the review of the allowances and seeks a continuation of the model which categorises Councils based on a consistent methodology.

Yours sincerely

Kerry Thompson

Chief Executive Officer

Municipal Association of Victoria

Ratepayers Victoria

A submission to the Determination of allowances for Mayors, Deputy Mayors and Councillors.

Dean Hurlston

President Ratepayers Victoria

August 2021

On behalf of the Volunteer Committee: Arthur Bregiannis, Chan Cheah, Claudio Bevilacqua, Eric Platt, Joseph Gianfriddo, Kelvin Granger, Lynnette Saloumi

Authored by Verity Webb

Introduction

The timing of this Determination, being sought by Local Government Minister Shaun Leane while ordinary people remain locked down, losing jobs and closing small businesses demonstrates starkly how easily we, the non-government people are overlooked in public service processes.

The documents and surveys cited by the Tribunal in its Consultation Paper for this Determination also suggest Councillors and some public servants fall a long way short of the skills and compassion required to represent residents with integrity.

This submission seeks to bring to the attention of the Tribunal, the impact on ordinary Victorians, of the additional cost of an increase in allowances for Mayors, Deputy Mayors and Councillors along with annual indexation.

Ratepayers Victoria argues that Councillor allowances should be frozen at their current dollar value, until all pandemic restrictions are lifted, and all Victorians are free to live, work and travel and have some certainty about their financial future.

In addition, Ratepayers Victoria requests the Tribunal determine that Councils stop paying superannuation to Councillors.

Financial Impact on Victorian Residents

There are more than three million ratepayers in Victoria and 76.3% of rate revenue comes from residential households.1

There is no readily available data to determine the impact of rates and rate increases on residential households in Victoria.

There is only disparate data from different agencies, that gives a rough idea of what the impact might be by providing some averages on employment, household wealth, household demographics and taxation.

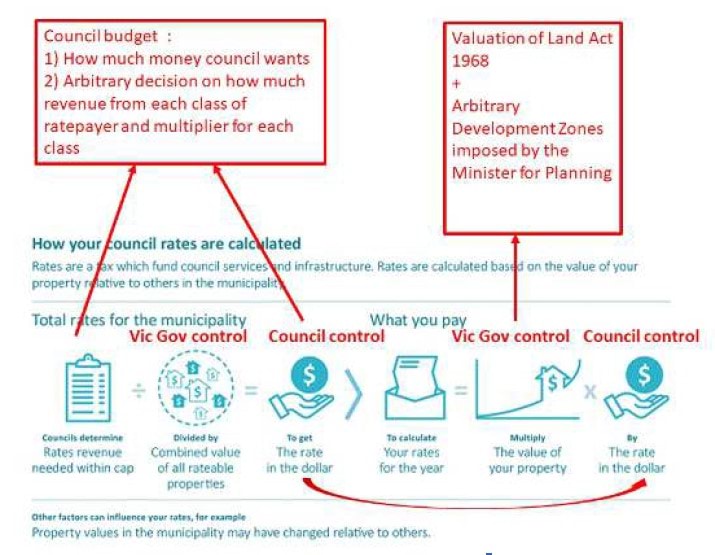

The Know Your Council website says the average cost of running Council in Victoria is about $3,400 per household per year and the average rates bill is $1,777.2

The most current ABS data on household income is for Australians in general in 2019 and estimates average weekly household income at $2349 per week.3