The growing demand for workers coupled with the current constraints on workforce availability is resulting in strong competition for workers, occupational shortages across many industries and other challenges for businesses and communities. These impacts are more acute in regional areas and industries that have historically relied heavily on migrants to meet demand.

Workforce growth is required to meet demand

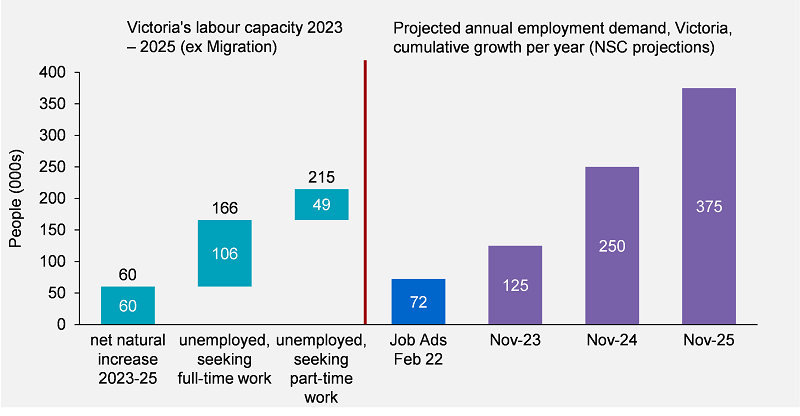

In February 2022 industry had approximately 72,400 vacancies, triggered in part by the rebuilding of workforces following 2 years of work disruption.15 Vacancy rates are expected to ebb and flow as absenteeism plays out over the next 12 to 18 months. The shortfall on current forecasts to 2025 is still likely even accounting for natural population growth, having unemployed people who want to work into jobs and the resumption of migration (refer Figure 6).

The challenges for industry cannot be overstated. Competition for labour will persist and be particularly pervasive in industries that are predicted to have the highest employment growth – health care, education and training and arts and recreation services. Industries such as retail, hospitality and agriculture have also experienced ongoing difficulties sourcing workers in recent years, compounded by the pandemic.

Occupational shortages are common across all industries

A total of 143 unique occupations are in shortage across all Victorian industries‡.17 Along with a widespread lack of potential workers, industry identified low training completion rates and challenges with attraction and retention of staff as contributing to increased difficulties meeting workforce demand.

In Victoria, the construction industry is experiencing the highest number of shortages, which includes electricians, landscapers and plumbers, followed by the services industry, which is requiring, among others, more bar staff, hotel and motel managers, and retail attendants (refer Figure 7). The health and community services industry is also facing widespread shortages, with aged and disabled carers, general practitioners (particularly in regional and remote areas), and social workers among approximately 15 unique occupations desperately needed to meet current demand. There are many other occupations that work across multiple industries that are in shortage, such as software and applications programmers.

Businesses experiencing workforce shortage also report a lack of candidates with the required skills or experience. This contributes to pockets of acute skills shortages, rather than across the labour market. Employers in these circumstances, and needing to change business models rapidly to respond to the pandemic, report it to be more cost effective to upskill existing staff who have valuable corporate knowledge and cultural capital than recruit new staff18.

Employers highlighted the inability to secure staff is likely to affect ongoing business operations. Reduced operating hours will hurt business viability and their ability to project an attractive proposition to prospective workers.

Workforce challenges are most acute in regional areas

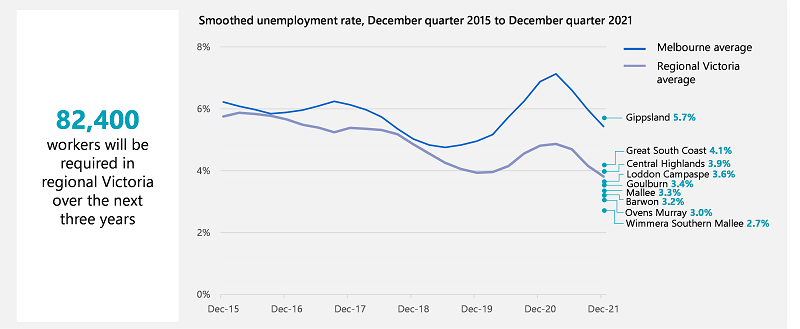

Workforce challenges are not new to regional areas. While unemployment rates have consistently been below metropolitan Melbourne (refer Figure 8),19 industry growth is impacted by a lack of available workers. For many regions unemployment has now hit record lows.

Shortages are identified across all industries, with vacancies now increasing for many as they are unable to fill existing positions. Specialist jobs are difficult to fill, and some workers need to work across several roles.

Regional consultations highlighted the significance of anchor occupations in keeping industries going, whether it is specialist roles for health services or trades for building and construction.

While several areas of regional Victoria have experienced population growth since the pandemic, securing the pipeline of workers will continue to prove challenging. Students completing school often leave their community in pursuit of education and other employment opportunities, contributing to the ongoing trend of an ageing population and increasing dependency ratios. Government initiatives driving the growth of regional economies will need to consider housing, transport and connectivity, care and education as part of the mix in building thriving communities that attracts skilled workers and their families to relocate.

References

2 Australian Bureau of Statistics 2022, Labour Force, Australia, Detailed, cat.no.6291.0.55.001, reference period March 2022, released April 2022, ABS, Canberra.

3 Nous (2022), modelling of National Skills Commission (2022) Employment Projections 2022–2025.

15 Victorian Skills Authority (VSA) analysis of National Skills Commission Internet Vacancy Index, 2022.

‡ A shortage exists when employers are unable to fill or have considerable difficulty filling vacancies for an occupation at current levels of remuneration and conditions of employment, and in reasonably accessible locations.

16 Nous analysis of Australian Bureau of Statistics 2022, national, state and territory population, reference period September 2021, released March 2022 and VSA, Deloitte Access Economics and Nous (2022), Retirement projections 2022–2025.

17 National Skills Commission Skills Priority List; Skills Plan consultation.

18 White, I & Rittie, T, Upskilling and reskilling: the impact of the COVID-19 pandemic on employers and their training choices, 2022, National Centre for Vocational Education Research (NCVER), Adelaide.

19 National Skills Commission (NSC) 2022, Small area labour markets, reference period December 2021, released March 2022, NSC, Canberra.

Updated